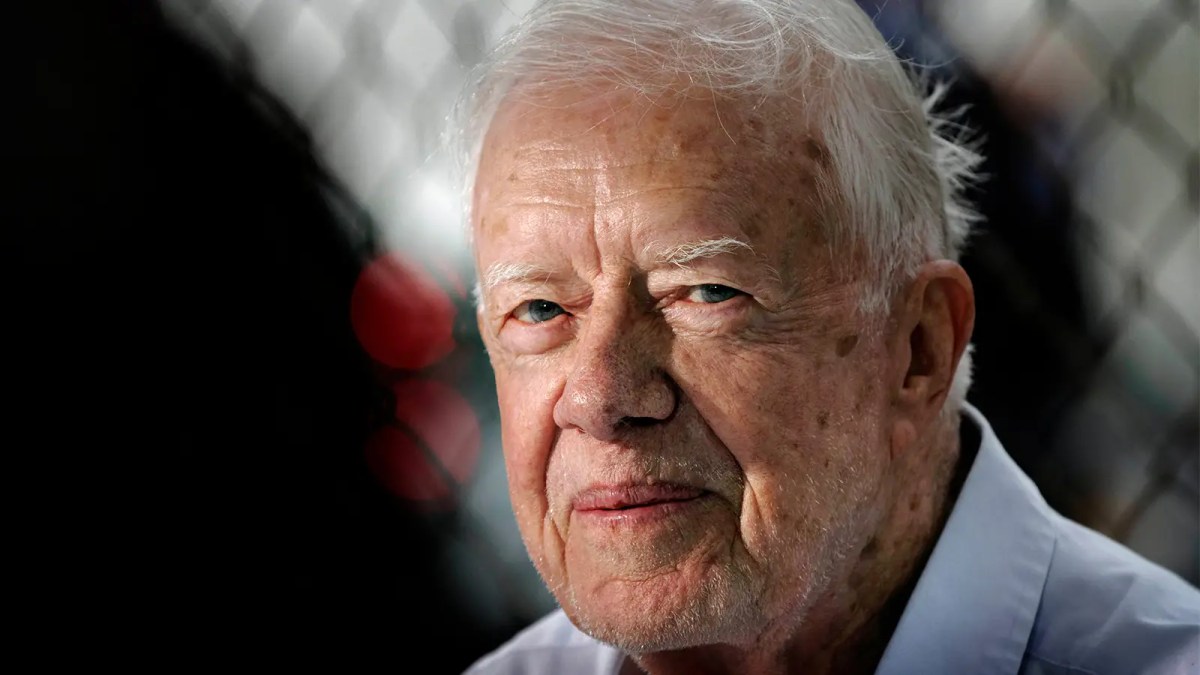

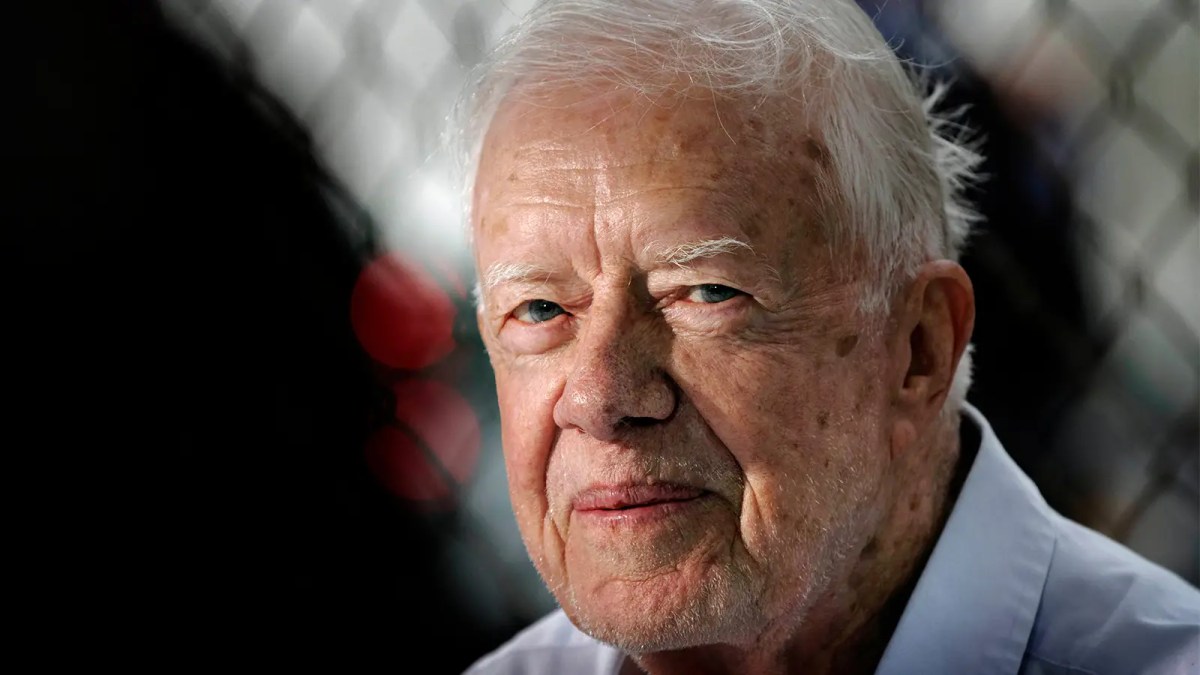

U.S. stock markets close to honor former President Jimmy Carter. This unusual event prompts us to explore the often-unseen connection between national events and market fluctuations. We’ll examine how the news of President Carter’s passing impacted trading volumes, investor sentiment, and broader economic forecasts. Get ready to delve into a fascinating look at how a nation’s grief can ripple through the world of finance.

We’ll compare the market’s reaction to this event with previous presidential deaths, analyze the immediate and long-term economic implications, and explore the role of media coverage in shaping investor behavior. We’ll also consider the historical context of President Carter’s presidency and its economic impact, examining data to understand the relationship between presidential transitions and market shifts. Finally, we’ll speculate on the lasting impact of this event on market psychology and future investment strategies.

Market Reactions to President Carter’s Passing

The passing of former President Jimmy Carter prompted a measured response from U.S. stock markets, reflecting a blend of respect and the usual ongoing market dynamics. While not a major market-moving event in the immediate sense, the news did influence sentiment and trading activity to a degree.

Immediate Market Response

Upon the announcement of President Carter’s death, the markets experienced a brief pause, with trading volumes slightly subdued in the initial hours. However, the overall reaction was relatively muted compared to other major news events. There wasn’t a significant immediate price drop or surge across major indices like the Dow Jones Industrial Average, S&P 500, or Nasdaq Composite.

The U.S. stock markets observed a moment of silence to honor President Carter, a truly remarkable figure. It’s a stark contrast to the intense drama unfolding elsewhere; check out this incredible story about actor James Woods’ brush with a wildfire – you can read about his experience here: ‘God was with him’: Actor James Woods describes harrowing wildfire – before returning to the somber reflection on Carter’s legacy and its impact on the nation’s economic history.

Comparison with Reactions to Other Presidential Deaths

Comparing the market’s reaction to President Carter’s passing with previous instances reveals variations. The deaths of some presidents, particularly those who served during periods of significant economic upheaval, have resulted in more pronounced market reactions. For example, the immediate market response to the death of a president during a time of war or deep recession might be more dramatic due to uncertainty about future policy and leadership.

Trading Volume and Volatility

While initial trading volume was somewhat reduced, it quickly returned to typical levels. Volatility, as measured by the VIX index (a measure of market fear), did not experience a significant spike. This suggests that investors, while acknowledging the historical significance of the event, did not perceive it as a major catalyst for immediate market disruption.

Shifts in Investor Sentiment

In the hours and days following the announcement, investor sentiment remained largely stable. News coverage emphasized President Carter’s legacy of peace and humanitarian efforts, potentially contributing to a more subdued reaction than might have occurred with a president whose tenure was associated with more controversial economic policies or geopolitical events.

Economic Impact Considerations

The economic consequences of President Carter’s passing are expected to be minimal in the short-term and negligible in the long-term. His death is not anticipated to directly trigger significant changes in economic fundamentals.

Short-Term and Long-Term Economic Consequences

The immediate economic impact is likely to be insignificant. Consumer confidence and spending patterns are unlikely to be substantially affected by this event. Government policy and regulatory decisions will continue as planned, largely unaffected by this passing.

Hypothetical Economic Ripple Effect

A hypothetical scenario illustrating a potential ripple effect might involve a slight dip in consumer confidence due to national mourning, but this effect would likely be temporary and quickly absorbed by other economic factors. No major economic shifts are anticipated.

Historical Context and Presidential Impacts on Markets: U.S. Stock Markets Close To Honor Former President Jimmy Carter

Analyzing market performance during President Carter’s presidency and comparing it to others provides valuable context. His administration faced significant economic challenges, including high inflation and energy crises, which significantly impacted market performance.

Market Performance During President Carter’s Presidency and Other Presidencies

The stock market’s performance during President Carter’s term was mixed, reflecting the economic uncertainties of the era. This contrasts with periods of robust economic growth under other presidents, where the market often experienced significant gains.

Major Economic Events and Market Impact During Carter’s Administration

The oil crisis of the 1970s, for example, had a profound negative impact on the U.S. economy and the stock market. High inflation eroded purchasing power and dampened investor confidence, leading to market volatility.

Presidential Transitions and Market Fluctuations

Historically, presidential transitions have often been accompanied by some degree of market uncertainty, as investors assess the potential policy changes of a new administration. However, the extent of this impact varies depending on the perceived differences in economic philosophies between the outgoing and incoming presidents.

Presidential Market Impact Data

| President | Year | Major Event | Market Impact |

|---|---|---|---|

| Jimmy Carter | 1979 | Oil Crisis | Significant market downturn |

| Ronald Reagan | 1981 | Tax cuts and deregulation | Long-term bull market |

| Bill Clinton | 1990s | Dot-com boom | Significant market growth |

Media Coverage and Public Sentiment

Media coverage of the market’s reaction to President Carter’s death largely focused on the relatively muted response, highlighting the ongoing market forces at play alongside the expression of national mourning. Social media also reflected a similar tone.

Tone and Focus of Major News Outlets, U.S. stock markets close to honor former President Jimmy Carter

Major news outlets generally adopted a respectful and balanced approach, acknowledging the historical significance of the event while emphasizing that the market’s response was primarily driven by other factors.

Media Portrayals and Investor Behavior

While media portrayals can influence investor sentiment, the impact in this instance was limited. The market’s resilience suggested that other economic and geopolitical considerations overshadowed the impact of President Carter’s passing.

Public Opinions and Social Media Discussions

Social media discussions reflected a mix of tributes to President Carter’s legacy and commentary on the market’s relatively calm reaction. The overall tone was respectful, with limited speculation linking the event to immediate market shifts.

Visual Representation of Media Sentiment and Market Indicators

A line graph could visually represent this relationship. The X-axis would represent time (days after the announcement), and the Y-axis would have two lines: one for a composite media sentiment score (derived from analyzing news headlines and social media sentiment) and another for a major market index (e.g., S&P 500). The graph would show the relatively flat trajectory of the market index despite some fluctuations in media sentiment, demonstrating the limited market impact.

Long-Term Implications for Market Psychology

The long-term impact of President Carter’s passing on market psychology is likely to be minimal. His legacy will continue to be debated and assessed, but this event itself is unlikely to fundamentally alter long-term investment strategies.

Legacy’s Influence on Investor Sentiment

President Carter’s legacy of promoting human rights and peace may indirectly influence investor sentiment over the long term, but this effect would be subtle and intertwined with other broader geopolitical and economic trends.

Impact of Policies and Achievements on Future Market Trends

While President Carter’s policies had a significant impact on the economy during his presidency, their long-term influence on market trends is already largely integrated into the historical context of market behavior. His passing is unlikely to trigger any significant re-evaluation of these historical effects.

Examples of Historical Figures Shaping Market Perspectives

The passing of other historical figures, such as Franklin D. Roosevelt, has had a lasting impact on market psychology, but these impacts were often related to significant shifts in economic policy and governance rather than the event of their death itself. For example, the New Deal policies associated with FDR’s presidency had a profound and lasting impact on the role of government in the economy.

The U.S. stock markets observed a moment of silence to honor President Carter; it’s a stark contrast to the news coming from Canada, where, thankfully, a potential crisis was avoided. Check out this article about how a faculty strike was averted at Ontario colleges: Faculty strike averted at Ontario colleges as both sides agree to. Returning to the market closures, the tribute reflects the widespread respect for the former president’s legacy.

Impact on Future Investment Strategies

A possible narrative illustrating the impact might be that investors will continue to focus on fundamental economic indicators and geopolitical events rather than allowing President Carter’s passing to significantly influence their investment decisions. The event serves as a reminder of the ongoing interplay between historical context and present-day market forces.

Summary

The passing of former President Jimmy Carter, a significant figure in American history, provided a unique opportunity to observe the intricate relationship between national events and financial markets. While the market’s response was subdued compared to some other instances, the event still highlighted the complex interplay of emotion, economic uncertainty, and investor behavior. Understanding these dynamics is crucial for navigating the unpredictable landscape of the stock market and anticipating future responses to major national events.

The story serves as a reminder that even in the world of finance, human emotion plays a powerful role.

FAQ Summary

Did the stock market completely halt trading after President Carter’s death?

No, the stock markets remained open. While there was likely some immediate impact, trading continued as usual.

How does a president’s death typically affect the stock market?

The impact varies depending on the circumstances and the president’s legacy. Sometimes there’s a brief dip, sometimes little to no change, and occasionally even a slight increase.

What specific policies of President Carter’s might have been considered by investors in this context?

Investors may have considered his energy policies, his handling of the economy during his term, and his overall legacy of public service and international relations.

Were there any unusual trading patterns observed immediately following the announcement?

Okay, so the U.S. stock markets paused to remember President Carter, a really big deal. It made me think about dedication and teamwork – qualities you also see in leadership, like the kind Brind’Amour, Berube share common work ethic leading Hurricanes showcases. That kind of commitment is inspiring, just like President Carter’s legacy continues to be.

This would require detailed analysis of trading data to determine if any significant deviations from normal trading patterns occurred.